I may be sad but I still have my sense of humor.

Friday, November 19, 2010

Slow Day Warning

My father died unexpectedly just almost three months ago. That is why I've been slow about posting. My mother-in-law is very, very ill and my husband is flying to the UK to see her tonight. That is why it will be a slow posting day today and possibly for a few more days. Just an explanation.

GM selling at a loss should tell you something

My husband's article from DailyCaller...

GM selling at a loss should tell you something

GM selling at a loss should tell you something

First, the government is what is known as a “motivated seller.” By offering such a low stock price, the administration is essentially admitting that it has no place in running an auto company. While GM’s financial position is much better than it was when it should have gone bankrupt, the company’s finances are not great. A quick crunch of any of the numbers in the GM prospectus shows the company is not the healthy organization the politicos would have you believe. They have done a poor job running the company, even if they did save it from going under by ignoring the law and throwing billions of dollars at it. The sale prospectus even admits “our (that is, the government’s) disclosure controls and procedures and our internal control over financial reporting are currently not effective.” Hardly a ringing endorsement!Read the whole thing.

Second, they’re not the only ones in the game. The unusual bankruptcy settlement for GM granted a significant portion of the company to the United Auto Workers. The union is in this game too, even though it has no investment to recoup. The UAW is selling around 18 million shares, so it stands to gain about $500 million for its pension fund — at taxpayers’ expense.

Finally, just as with RailTrack, there is considerable political risk involved. If the feds could nationalize GM once, they can do it again. The company admits in its prospectus that “The UST [U.S. Treasury] (or its designee) will continue to own a substantial interest in us following this offering, and its interests may differ from those of our other stockholders.” It suggests that government might interfere in “The selection, tenure and compensation of our management; our business strategy and product offerings; our relationship with our employees, unions and other constituencies; and our financing activities, including the issuance of debt and equity securities.” Furthermore, the government has asserted sovereign immunity, meaning that the IPO is not subject to anti-fraud laws.

Good Lord What A Mortgage Mess

This is as reasonable a demonstration of the mortgage mess we are in as any...

Man Makes Ridiculously Complicated Chart To Find Out Who Owns His Mortgage (CHART)

Man Makes Ridiculously Complicated Chart To Find Out Who Owns His Mortgage (CHART)

Thursday, November 18, 2010

Daily Round-Up 11-18

Time for Holder to go AND Holder Should Resign Or Be Fired, and Obama Should Apologize

Exclusive Excerpts From New Black Panther Case Investigation Report (Full Report Due Tomorrow)

AND THE GOOD NEWS IS....

Sarah Palin's happiness is what really irks liberals

Report: US Has Large Stores of 'Rare Earth' Materials

America's Third War: Texas Strikes Back

GENERAL BAD BEHAVIOR

The New York City Council Takes (Bad) Aim at Crisis Pregnancy Centers

The Campaign to Protect Our Illegal Alien Criminals

PJTV Video - Don't Touch My Junk: Napolitano Turns TSA into Department of T&A

Court to Issue Warrant for Assange

Terror-trial travesty

Dear TSA, No Means No AND TSA does not perform psychological evaluations on officers, should they?

Time for Holder to go

BIG UNION/LEFTIE GROUPS

Labor to push for China currency bill during lame-duck session

Let's hope note - No union for Transportation Security workers

The New York City Council Takes (Bad) Aim at Crisis Pregnancy Centers

Muslims seek special treatment to elude TSA groping

Illinois Teachers’ Union Wines and Dines Into the Red

FIGHTING CORRUPTION/TEA PARTY NEWS

Republican establishment needs to stand with the Tea Party

What Sparked the Tea Party

Boehner, Tea Party May Clash Over Ethics Office

Arizona Boycott Over Immigration Finds Mixed Results

Bad Politician Bad 11-18

President Obama Job Approval

Citizens United Likens Pelosi Election to Fruitcake Regifting

Mirengoff on the Socialism Question

And the DREAM Shall Never Die

You've Got Them All Wrong, Mr. President. Obama's misguided view of the independent voter.

Author of DOJ report targeting NJ Governor Chris Christie has history of using position for political purposes, sources say

Oh that Jim Treacher - Be sure to sign the ‘thank you’ card for Nancy Pelosi

With GOP in control of House of Representatives, committees should begin giving public answers

Time for Holder to go And Commentary From InstaPundit -

And making an even bigger mockery of the whole thing is the Administration’s claim of “post-acquittal detention power.” So the whole thing was just a show trial anyway. Ah, remember the fierce moral urgency of change? Apparently, it was the fierce moral urgency of show trials. But that doesn’t get Holder off the hook. He botched a show trial, after all . . .President Bush never attempted "post-acquittal detention power" and yet I haven't heard any "BusHitler" assclowns complain that Obama is doing something far, far worse. Typically hypocritical if you ask me.

PJTV Video - Democrats to Obama: Don't Run in 2012

Carville, Greenberg: White House Doesn’t Get It

The George W. Bush Fixation Obama’s fixation on his predecessor could consume his presidency.

Obama’s Gifts to the GOP

Former U.S. attorney targeted in DOJ report seeks apology, correction

Rahm Residency Issue Grows

GOP governors already looking to 2012 election

Freudian slips may haunt Obama

Ethics chief counsel recommends censure for Rangel

Food Fight Breaks Out in Senate

Media Bias 11-18

Sharpton To Schultz: FCC Should Threaten Radio Stations Carrying Rush

The New York Times, Sarah Palin, and the ‘Gravitas Gap’

Sen. Rockefeller: FCC Should Take FOX News, MSNBC Off Airwaves

MSNBC’s Contessa Brewer Pleads for Government-Forced Environmentalism

PJTV Video - What's the Matter With America? (Soros, Huffington, Krugman, Maher, & Olbermann Can't Be Wrong)

The New York Times Calls 70% of Oklahomans Bigots

In Economic Woes 11-18

California Suggests Suicide; Texas Asks: Can I Lend You a Knife?

Silence of the CEOs. Speaking out is now dangerous

Obama's Uncertain Economy No Good for Business

The 2011 Tax Tsunami

The trap of the Federal Reserve's dual mandate

Mitch Daniels’s Next Hurdle Cutting Indiana’s budget even further will be hard, but a newly Republican legislature will help.

Chicago City Pensions are Broke Expect other cities to follow.

McConnell Opposes $1.1 Trillion Spending Bill

No Unemployment Extension

Fiscal issues trump social issues by … quite a lot

Big Mac alert!

Tax rates and the sordid soul of the left

Junk Science 11-18

Obamacare 11-18

Repealing Obamacare, state by state

Mitt’s bad medicine

American Health Care and American Productivity: An International Comparison

U.K. government's drug-rationing body can no longer refuse new medicines based on costs. The U.S. should follow suit.

Boehner: GOP will move 'quickly enough' to repeal healthcare law

Joining the ObamaCare Suit Newly elected state officials—and Chris Christie—should sign onto the Florida case..

Perspectives: A referendum on ObamaCare?

New Obama Administration Health Care Guru: Double Counting? What Double Counting?

How does America achieve affordable, accessible, quality health care?

Obama’s ‘Rationer in Chief’ Finally Sits in Judgement Before US Senate

Wednesday, November 17, 2010

Random Round-Up 11-17

President Obama Job Approval

Political Hit-Job from Obama's DOJ AND Smoking e-mails?

The Obama administration is propagandizing like it was still 2008, but this time using tax dollars like campaign donations in a way that may not be legal.

Soros Disses Obama

Congressional watchdog group calls on Rangel to resign

Time to stand up and vote all the Rangels out

The secret silencing of a pain treatment activist

The Uncertainty Certainty

The Wages of Spin

TSA to investigate body scan resister Oceanside man took a stand against security, went viral

Why the BBC cannot be trusted on 'Climate Change': the full story

When the history of the greatest pseudoscience fraud in history – aka “Climate Change” – comes to be written, no media organisation, not even the Guardian or the New York Times, will deserve greater censure than the steaming cess pit of ecofascist bias that is the BBC. That’s because, of all the numerous MSM outlets which have been acting as the green movement’s useful idiots, the BBC is the only one which is taxpayer-funded and which is required by its charter to adopt an ideologically neutral position.I like City Journal so here is this - Intellect and Influence in NYC

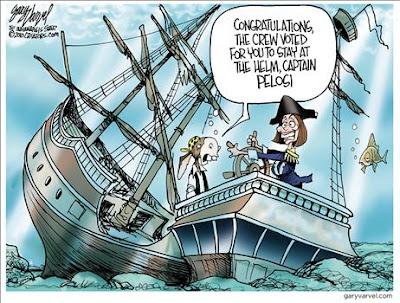

Pelosi Wins Bid for Leader Despite 43 Defections

Rangel’s Ethics Violations

House Dems cry like little babies who just got spanked, appropriately enough

Sea Life Flourishes in the Gulf The Great Oil Spill Panic of 2010 will go down in history as mass hysteria on par with the Dutch tulip bubble.

The horrible truth starts to dawn on Europe's leaders

States on the brink

Rangel Should Have Worked for the UN

Economies of Scale Don't Apply to Government

Union Members: Where Do Your Dues Go?

GM Benefits from Tax Law Ruling

Who Stole Election Day? Too many voters are making decisions when horse-race coverage dominates the news, attention to issues is limited, and key debates haven't taken place.

Should your state establish an Obamacare health insurance exchange?

Veteran slams VA as ‘worst’ part of injury

He must have found the time by blowing off his job - Obama out with kids book

Walsh wins seat by 291 votes

China’s Economic Miracle Is Over

Obama reassures Dems on tax cuts

Pretty in Pink? Obama’s Dark Night of the Soul

GOP ideas can fix health care reform

ObamaCare to debut in Calif. - will it fly?

Actually, You Do Have a Messaging Problem, When Your Message Is Sheer Arrogance. Marshall McLuhan was right: when it comes to Barack Obama, the medium really is the message

Why Can't Doctors Tell Patients How Much Meds Cost?

DOJ’s Military Voting Mess Continues Post-Election, but Congress Now Paying Attention. If you serve our nation and your ballot came too late or wasn’t counted, let PJM know so we can get the message to Congress. Send your stories to story@pajamasmedia.com.

The big disconnect: D.C. elites think Obama will be reelected, but the public doubts it

Liberty-Loving Latinos Outshine Loud-Mouthed Leftist Latinos. Hispanics owe a debt of gratitude to African Americans for showing us what allegiance to the Democrat Party can bring.

What Is America’s Role in the World?

It's not a message problem

Guilty -- and still whining

Rep. Upton Vows to Fight for Tea Party Principles

Tort Reform (Tort Law Tally)

Roger Ailes Lets Rip

Obama DREAMs of Amnesty. Pushing toward amnesty may seem insane, but this president is a hard edged ideologue who is dipping into his community organizer bag of tricks. And he knows exactly what he's doing.

Why Democrats don't dump Nancy Pelosi

Will residency be the Rahmstopper? Emanuel twice purged from voter rolls

Monday, November 15, 2010

No Justice from the DoJ

Explosive New Justice Department Black Panther Emails

It is now obvious to me why the Obama administration continues to be so secretive regarding the DOJ’s New Black Panther Party decision. These documents show that not only was the New Black Panther Party decision shamelessly politicized by the Obama administration but also that Obama officials lied to cover up the scandal. These documents raise more questions about Attorney General Holder’s involvement as well.Lots of links to source documents. The proof is piling up that Holder, the DoJ, and Obama lied.

Troubled Company or Apocalypse Now?

The Cisco in the Coal Mine

Here’s why Cisco Systems’ bad financial news last week should (maybe) scare the hell out of you.There's more. Read the whole thing and be afraid.

First, in case you missed it, here are the details of the announcement. On Thursday, Cisco stunned both the tech world and the stock market when it cut its sales forecast for the second quarter in a row. Worse, chairman and CEO John Chambers said that the company’s current situation is the result of outside forces beyond the company’s control – in particular, declining orders from cable companies and government agencies.

The market responded quickly and strongly to such depressing news from one of the linchpins of the U.S. economy: the Dow fell nearly 74 points, or 0.7 percent to close at 11,283.10. It could have been a lot worse – at one point in the day trading was down as much as 126 points.

Needless to say, Cisco stock was bloodied as well: it fell $3.97 (more than 16 percent) to $20.52. That instantly erased nearly $24 billion in worth from one of the world’s most valuable companies.

Still, having been buffeted by hard economic times for the last two years, the Cisco announcement was quickly assimilated as just the latest piece of bad news in what seems like an endless run of such bleak corporate announcements. What seemed at the beginning of last summer as the long-awaited start of a turnaround in the U.S. economy, now is beginning to feel like the beginning of a long malaise and a dishearteningly shallow recovery. Even the careful optimism coming from other tech bellwethers like Intel and Google (notably the across-the-board raises and bonuses at the latter) hasn’t been enough to raise spirits in the tech world.

And so, despite the Cisco announcement, both the stock market and the tech world ended the week about where it began, with an attitude of More of the Same. . .and awaiting that one message that will point which way the economy is going to go: towards recovery or a double dip; inflation or deflation, optimism or despair.

Enviros Love Regulations But This Will Hurt

Trojan Horse Law: The Food Safety Modernization Act of 2009

A misguided bill, the Food Safety Modernization Act of 2009, may shut down farmer’s markets and “drive out of business local farmers and artisanal, small-scale producers of berries, herbs, cheese, and countless other wares, even when there is in fact nothing unsafe in their methods of production,” warns legal commentator Walter Olson at Overlawyered.Read the whole thing. I don't know whether to laugh or weep.

Sunday, November 14, 2010

Random Round-Up 11-14

President Obama Job Approval

Nailed! ACORN Supervisor Convicted for Election Fraud

Rangel 'raided' PACs for 393G

Name That Party: Another Criminal Democrat Goes Unidentified by Old Media

Time to close the open bar in Washington

The Entitlement Crisis

Heath Shuler discusses run for minority leader with CNN

After Struggles, Obama Seeks Lift in Japan

ABC: So that Obama trip to Asia turned out to be a huge bust, huh?

The Liberal Crisis

PJTV Video - Tony Katz, Comically Speaking: Salt, Sugar and Fat, Oh My! Nanny State Sticks Its Nose in Your Food

Expert: past 10 days have been worst of President Obama's 'political life'

Chris Christie's Star Turn Raises National Prospects, Nearly $9 Million for GOP

I want, I want. I need, I need! Virginia Bill Asks For Tea Party License Plate

Stop Smearing Federalism. From consumer advocacy to gay marriage, liberals routinely embrace federalism. So why do they keep comparing it to slavery?

Experts weigh in: Can the economy be saved?

Missouri Dem warns McCaskill against 'disloyalty' to Obama

Will Stealth Spending Decide the 2012 GOP Presidential Primaries?

Get Ready for the Great MERS Whitewash Bill

Barton denies he is using opposition research to upend Upton challenge

Groups Funded by Soros Network Back Soros

Climbing Mount Publishable. The old scientific powers are starting to lose their grip

A bad news week for AGW proponents

PJTV Video - Red, White & Gadsden Yellow: Tea Party Election Influence with FreedomWorks' Matt Kibbe

Bernanke's relationship with GOP deteriorating over Fed decisions

Obama can't get G-20 nations to follow his lead

Means To An End To Big Spending

Left-Winger Tina Brown Heads Daily Beast/Newsweek Merger; A List of Her Liberal Rantings

Fixing errors online needs some correcting at news organizations

Obama Fudges His Afghan Deadline

America Declines To Lead

Embarrassment in Seoul The world won't follow slow-growth, weak-dollar America.

How's that stimulus workin' for ya? A look back.

In her new reality show, it’s obvious Sarah Palin can work the media

Why Wall Street should fear Sarah Palin

Public pension liabilities pose future threat

CNN Claims No Favorites, But MRC Data Shows Campaign Coverage Skewed Left

'New York Times’ Gushes Over Communist Community Center

Four Reasons to Worry About the Newsweek-Daily Beast Deal.

NY's God-awful GOP

Where Will the G.O.P. Go Digging?

One and done: To be a great president, Obama should not seek reelection in 2012 AND The WaPo Shivs The One

Axelrod starts Obama's re-election work next year

Class dismissed: Why middle income jobs are not coming back

Bury the Estate Tax for Good

Peggy Noonan - Wrong, Wrong, And Wrong

Surprise, California! Budget Deficit 25 Percent Worse Than a Month Ago

Obama’s Trade Strategy Runs Into Stiff Resistance

Getting our Fiscal House in Order

Can pay, won't pay. America’s most profligate states do not owe as much, proportionately, as Greece. But their politics are just as problematic

American Narcissus. The vanity of Barack Obama

GOP Staking Claim to Obama's Coalition of Voters

Healthcare (October 2010)

Here’s a Woman Fighting Terrorism. With Microloans.

Native American Farmers Shake the Public Money Tree

Fiscal Crises and Imperial Collapse

California's Whooping Cough Epidemic Centered in Rich, White Counties. Only liberal greenies avoid vacinations. Dumbasses.

Obama=Bush? President Obama isn’t the new Carter, but he just might be the new (first) Bush

Study shows reusable bags contain high levels of lead content

Loads of Unions on exemption list - Approved Applications for Waiver of the Annual Limits Requirements of the PHS Act Section 2711 as of November 1, 2010

Long wait for food safety bill may be over

Fed Up: The Cost of Ben Bernanke’s Monetary Kamikaze Mission

Rand Paul: Fiscal commission report doesn't go far enough

Pot and kettle

Shuler on Pelosi: If 'she doesn't step aside, I will challenge her' for top post

Why Isn’t Mexico Rich?

No Camelot 2.0 The decline of liberal idealism.

Media Research Center: Bachmann and other conservative women treated unfairly by mainstream media

“The First Amendment, well how quaint!”

Two Wonks with One Plan About Too Much Debt

Democrats' campaign fortunes rise and fall with Obama's popularity

What the Deficit Commission Draft Ignores

The White House vs. science

The Decider returns to haunt Mr Nuance as George W. Bush eclipses Barack Obama

White House Push-Back on Asia Trip Failure Meme

San Francisco mayor vetoes happy meal ban

Investing in a frenzied market. Certain start-up markets may have gotten too hot, but that should be a reminder for investors to find opportunity where the crowd isn't.

An Open Letter to Republican Freshmen Members of Congress

No Country for Burly Men. How feminist groups skewed the Obama stimulus plan towards women's jobs

Barack Obama: the most anti-Israel president ever

We Told You So

Miller: Ballot Fight Rests on Alaska Vote Count

South Park - Obama All Over Again

Is Obama Trying to Turn the Border into the Next ‘Third Rail’? The border is a national security issue, but a defeated Obama is less likely to triangulate than he is to polarize.

Obama panel probes stimulus waste -- at Ritz Carlton

'We're Women. We Were Trained To Be Nice. We Weren't Direct Enough'

The Obamamometer The perfect candidate breaks from script.

Education (September 2010)

This is the Moment

Business community opposes Paycheck Fairness Act

Man up, Media and Open Your Eyes!

Subscribe to:

Comments (Atom)